If you’re running a nursing home today, you already know the pressure is real. Costs keep rising, staff are harder to keep, and compliance penalties feel like they’re always around the corner. But behind all those challenges, there’s one factor quietly shaping your financial health every single day: your payer mix.

Put simply, payer mix is the breakdown of who’s paying your facility — Medicare, Medicaid, private insurance, or self-pay. And here’s the truth: it’s the difference between staying profitable and struggling to keep the lights on.

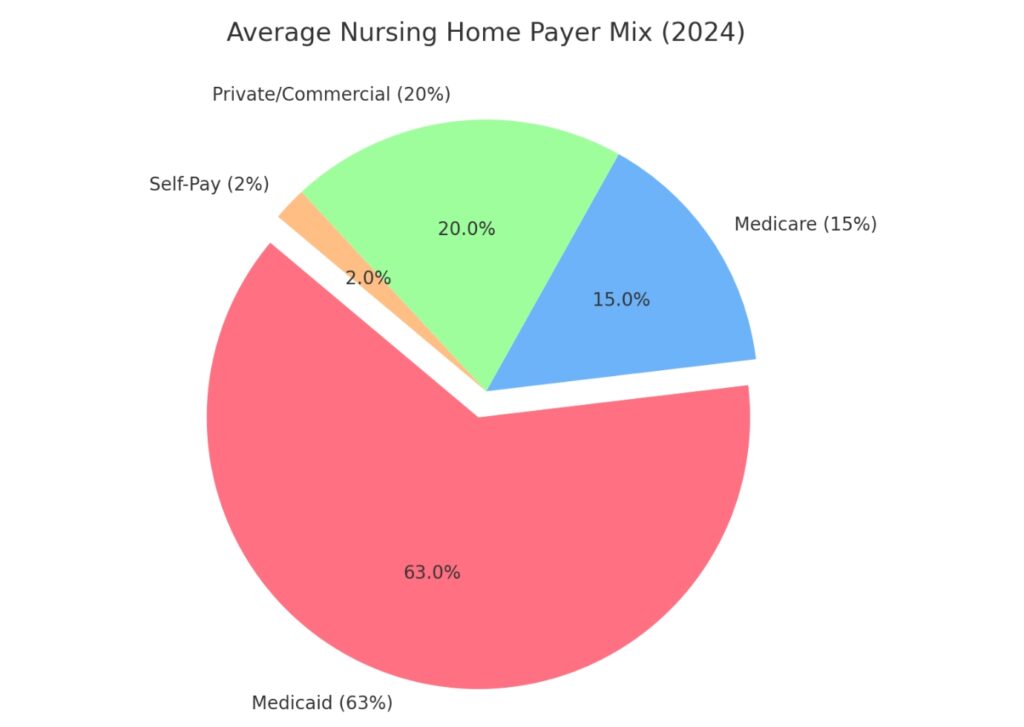

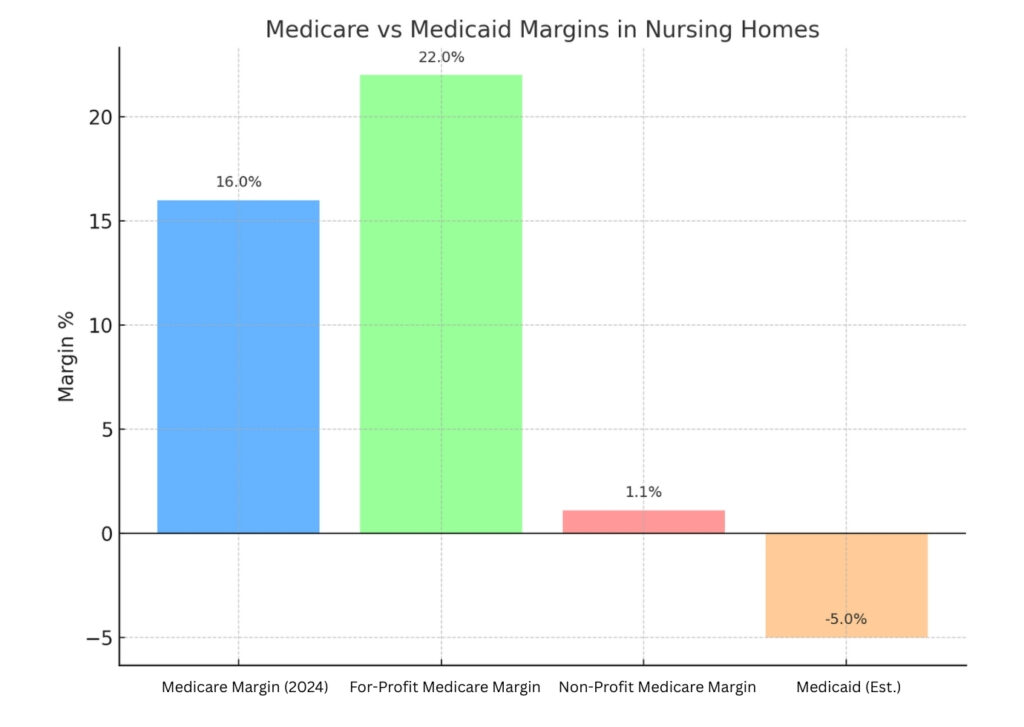

Why does it matter so much? Because not all payers reimburse equally. In 2024, for example, the average Medicaid daily rate often fell below the actual cost of care, while Medicare margins averaged 16% — and for-profit facilities captured even higher at 22%. Meanwhile, 45% of nursing homes still reported operating at a loss.

So, if your census is tilted heavily toward Medicaid, you’re already fighting uphill. But the good news is, you’re not powerless. In this blog, we’ll break down how payer mix impacts your bottom line — and more importantly, what you can do about it to protect revenue, reduce risk, and strengthen your facility for the future.

What Is Payer Mix—and Why It Matters?

Let’s keep it simple: payer mix is just the recipe of where your revenue comes from. In nursing homes, that usually means:

The Four Main Payer Sources

- Medicare : short-term, higher-acuity stays, usually after a hospital discharge.

- Medicaid: long-term custodial care for residents who can’t pay privately.

- Private/Commercial Insurance: employer plans, managed care contracts.

- Self-Pay / Private Pay: residents or families paying out-of-pocket.

On paper, that looks straightforward. But here’s where it gets tricky: each payer reimburses at very different rates.

The Reality Check: In 2024, Medicare margins averaged about 16% overall, with for-profit facilities doing even better at 22%. Medicaid tells a very different story — it often pays below the actual cost of care, even though it covers nearly two-thirds of long-stay residents That’s why nearly half of all facilities (45%) operated at a loss in 2024.

This is why payer mix matters more than just occupancy. You could run at 90% full, but if most of that census is Medicaid, your margins stay razor-thin. On the flip side, a more balanced payer mix — even at lower occupancy — can put you in a stronger financial position.

In short: your payer mix is the lifeline of your business model. Get it wrong, and you’ll always be chasing cash. Get it right, and you’ll have the stability to invest in staff, improve quality, and grow.

The Financial Impact of Payer Mix

Here’s the hard truth: payer mix makes or breaks your bottom line. It’s not just about how many residents you have — it’s about who’s paying the bill.

Let’s look at the numbers: In 2024, the average SNF Medicare margin was 16%, with for-profits reaching 22%. Nonprofits, by comparison, scraped by with 1.1%.

- Medicaid, which covers the majority of long-stay residents, often reimburses below the cost of care. No surprise then that 45% of nursing homes reported operating at a loss.

- Occupancy helps, but only if the payer mix is healthy. With the average revenue per bed at $111,820 per year, each 1% increase in occupancy adds ~$130,000 annually to a 116-bed facility. But here’s the catch: if most of those extra residents are Medicaid-funded, that “gain” may actually widen the loss.

What this means for you:

- A Medicaid-heavy facility faces constant cash flow stress, forcing tough choices on staffing and resources.

- Facilities with stronger Medicare and private-pay shares enjoy better margins, more predictable cash flow, and room to reinvest in staff and quality.

- Bottom line → payer mix directly drives your ability to pay competitive wages, avoid turnover, and stay survey-ready.

Think of payer mix as the engine under the hood. Two facilities can look the same from the outside — similar census, similar staff size — but if one runs on a Medicaid-heavy engine and the other has a balanced mix, their financial performance will be worlds apart.

Challenges Facilities Face With Payer Mix

If payer mix was easy to balance, every nursing home would be profitable. The reality? Most operators face the same set of uphill battles:

1. Overdependence on Medicaid

For long-stay residents, Medicaid is the default. The problem is, Medicaid often pays below the actual cost of care. That’s why even with full occupancy, many facilities are running in the red. In fact, 63% of long-term residents are Medicaid-funded.

2. Claim Denials and Revenue Leakage

Even when services are covered, you don’t always get paid. The SNF improper payment rate sits at 15.1% — meaning a big chunk of revenue slips through the cracks due to billing errors, missing documentation, or prior authorization issues. Across all payers, 19–20% of in-network claims are denied. Each denial delays cash flow, forces rework, and in some cases, results in lost revenue altogether.

3. Workforce Strain and Turnover

A weak payer mix = weak margins = less money for staffing. That creates a vicious cycle.

CNA turnover averages 63.2%, RN turnover 50.9%.

Replacing one RN costs about $56,300 — a hit many Medicaid-heavy facilities can’t absorb.

It’s not just about money. When staff turnover stays high, care gets disrupted, citations pile up, and the whole facility feels less stable.

4. Compliance and Penalty Risks

CMS doesn’t give much grace when financial stress leads to shortcuts.

- One of the most common citations across the country is F-Tag 880 for infection control.

- Penalties aren’t light — immediate jeopardy fines have averaged around $55,000.

- The ultimate risk is DPNA (Denial of Payment for New Admissions), which can cut off your primary revenue stream almost instantly.

The big picture: The impact of payer mix goes far beyond the balance sheet. It affects how you staff, how surveyors judge you, and how families view your facility. Rely too heavily on low-paying sources, and you’re not only leaving money behind — you’re also multiplying your risk on every front.

Strategies to Improve Payer Mix

The good news? You don’t have to stay stuck with an unprofitable payer mix. Facilities that take control of admissions, referrals, and data can shift the balance toward better margins. Here’s how:

1. Strengthen Referral Relationships

Hospital discharges are still the main gateway for admissions. In fact, nearly 90% of SNF admissions come through hospitals. That means your relationship with discharge planners is critical. The ones that trust you will send you more referrals — especially Medicare and rehab patients. Keep your CMS ratings strong, make communication easy, and show you can admit quickly. That combination keeps you at the top of their list.

2. Invest in Specialized Programs

Not all beds are equal. Facilities that lean into post-acute rehab consistently attract more Medicare short-stay patients, which deliver higher reimbursement. Likewise, dedicated memory care units tend to draw private-pay residents, giving you a much-needed counterweight to Medicaid-heavy census. Specialization isn’t just about marketing — it’s about shaping your payer mix toward sustainability.

3. Tighten Eligibility Verification

Too many facilities lose revenue before a resident even arrives. Missed authorizations and eligibility errors are common reasons for denied days. With the SNF billing error rate at 15.1%, every mistake stings. By making eligibility verification part of the admissions process — not an afterthought — you can protect revenue and avoid scrambling later.

4. Track Payer Mix in Real Time

You can’t improve what you don’t measure. Spreadsheets and quarterly reviews won’t cut it anymore. Facilities that monitor payer mix daily catch problems early, forecast cash flow more accurately, and make smarter admissions decisions. Real-time analytics aren’t a luxury — they’re survival tools.

5. Improve Quality Ratings to Attract Better Payers

Your star rating is more than a compliance scorecard — it shapes your revenue. A one-star improvement can increase private-pay census by 3–5% and opens the door to hospital preferred networks, which means more Medicare referrals. Quality and payer mix are tied at the hip. Invest in staff, infection control, and care processes, and the financial upside will follow.

Takeaway: Optimizing payer mix isn’t about filling every bed. It’s about filling the right beds, with the right payers, while protecting every dollar with better processes and stronger data.

How Technology Helps?

Balancing payer mix is not just a finance issue — it’s an operational challenge. The facilities that win are the ones that use technology to stop revenue leakage before it happens.

Here’s where smarter tools make the difference:

Eligibility Verification at Admission

Most denials come from missing or late authorizations. With real-time eligibility checks, you capture Medicare and managed care coverage upfront, so you don’t lose billable days later.

Admissions Management

Every day a referral sits in limbo is lost revenue. A streamlined admissions workflow means you can respond faster than competitors — and convert more of the right referrals into residents.

Analytics Dashboards

Let’s be honest — spreadsheets just don’t cut it anymore. By the time you’ve updated them, your payer mix has already shifted. Facilities need real-time visibility to see what’s happening today, not last quarter. With live dashboards, you can forecast cash flow, adjust your admissions strategy, and give stakeholders the kind of clarity that builds confidence.

Compliance & Documentation Support

Billing errors and incomplete records are costly — in fact, they account for about 15.1% of improper payments in SNFs.The fix isn’t more paperwork, it’s smarter systems. Integrated documentation tools keep your clinical and financial data aligned, so what you deliver in care is fully supported by what you bill.

Why this matters: The old way of managing payer mix — reactive, manual, and paper-heavy — doesn’t just slow you down. It leaves money on the table, opens the door to denials, and makes staffing cuts more likely. Facilities that modernize protect both their revenue and their reputation.

Compliance & Risk Considerations

When your payer mix leans too heavily on low-reimbursing sources like Medicaid, the problems don’t stay in your finance office — they spill over into compliance, staffing, and even reputation.

Survey Citations

One of the clearest warning signs? F-Tag 880: Infection Prevention & Control. It’s the most common deficiency cited nationwide, and it’s no coincidence. Facilities that can’t afford enough staff often struggle to maintain strict infection control, and surveyors notice.

Civil Monetary Penalties (CMPs)

The fines can be devastating. Per-day penalties for serious deficiencies range from $3,050 to $10,000. During the COVID era, some facilities saw average fines of $55,000 for immediate jeopardy infection control failures. For a Medicaid-heavy facility already surviving on thin margins, a single CMP can erase months of revenue.

DPNA: The Nuclear Option

If problems aren’t fixed quickly, CMS can issue a Denial of Payment for New Admissions (DPNA). For most facilities, that’s like turning off the faucet. With no new residents coming in, your primary revenue pipeline shuts down until compliance is restored.

Star Ratings and Referrals

Here’s where compliance ties back directly to payer mix. Hospitals and families look at CMS star ratings before sending patients. A one-star bump doesn’t just look good on paper — it can increase your private-pay census by 3–5%. Slip to the bottom, and you’ll be left with the lowest-paying payer categories.

The big picture: A poor payer mix isn’t just a financial problem — it multiplies your risks. Weak margins make it harder to staff, which drives citations, penalties, and lower ratings. And once your star rating drops, your access to Medicare and private-pay residents shrinks, leaving you even more dependent on Medicaid. It’s a vicious cycle, but one you can break with the right strategy.

Key Takeaways

At the end of the day, payer mix is the heartbeat of your facility’s financial health.

- If you’re too Medicaid-heavy, you’re working with razor-thin or even negative margins. Even at full occupancy, the math just doesn’t work.

- A balanced payer mix brings stability. Medicare and private-pay residents provide the cushion that lets you reinvest in staff, strengthen compliance, and improve quality.

- Revenue leakage is real. With billing error rates at 15.1%, every unchecked denial chips away at cash flow.

- Staffing and compliance aren’t separate from payer mix — they’re symptoms of it. Thin margins drive turnover, which leads to survey citations, CMPs, and lower star ratings.

- Every 1% occupancy increase is worth about $130,000 a year in a 116-bed facility But that growth only helps if those beds are filled with the right mix of payers.

Bottom line: Payer mix is the difference between just surviving and truly thriving. The facilities that watch it closely, protect revenue through smarter processes, and invest in the right tools are the ones that will stay strong — for their staff, their residents, and their future.

You don’t have to accept razor-thin margins as “just the way it is.” The truth is, your facility can get out of survival mode by managing payer mix smarter. With the right balance, you’ll have the cash flow to pay staff fairly, keep quality strong, and protect your reputation with families and hospitals alike.

The challenge isn’t knowing payer mix matters — it’s having the visibility and tools to act on it. That’s where technology steps in.

At LTC Apps, we built tools that give administrators real-time insight into payer mix, streamline eligibility verification, and stop revenue leakage before it starts. It’s about helping you protect every dollar you’ve earned, so you can focus on care, not paperwork.

Because at the end of the day, strong margins don’t just keep the lights on — they keep your residents safe, your staff supported, and your facility future-ready.

Frequently Asked Questions

Because not every payer reimburses the same. Medicare, Medicaid, private insurance, and self-pay all pay at different rates — and that mix decides how much money your facility actually keeps. A strong payer mix means steady cash flow and room to reinvest. A weak mix, especially if it leans too heavy on Medicaid, can leave you struggling even at full occupancy.

Patient mix simply means who you’re caring for and how they’re paying. In most nursing homes, that’s a blend of short-stay Medicare patients, long-stay Medicaid residents, private-pay families, and some managed care. The balance matters, because it shapes both your financial health and your care model.

It’s not about filling more beds — it’s about filling the right ones. Build strong hospital referral networks to capture more Medicare patients, invest in programs like rehab or memory care to attract private-pay, and tighten eligibility checks to stop losing days to denials. Facilities that track payer mix daily have the best shot at shifting it in their favor.

There’s no magic formula, but most operators aim to keep Medicaid below 65% of total census. The rest should come from a healthier balance of Medicare and private-pay. That mix creates enough margin to cover costs, pay staff competitively, and keep quality strong.

A Medicaid-heavy facility often runs on razor-thin margins, which creates a domino effect: staffing shortages, high turnover, and more survey citations. By contrast, facilities with stronger Medicare and private-pay shares have better cash flow, lower turnover, and the ability to reinvest in care. In short — the right payer mix is what keeps the doors open and the care consistent.